Accounting Equation Cost of Goods Sold

Accounting Total Cost Formula will sometimes glitch and take you a long time to try different solutions. Cost of Goods Sold Beginning Inventory Value - Ending Inventory Value Total Inventory.

Cost Of Goods Sold Cogs Formula And Calculator

Starting inventory purchases ending inventory cost of goods sold.

. Rated The 1 Accounting Solution. The cost of goods sold formula is calculated by adding purchases for the period to the beginning inventory and subtracting the ending inventory for the period. Because the financial impact of lost or broken units cannot be ascertained in a periodic system the entire 2080 is assigned to either ending.

Cost of goods sold is the total of all costs used to create a product or service which has been sold. Heres how calculating the cost of goods sold would work in this simple example. The cost of goods sold will be calculated on.

The cost of goods sold will be calculated on Form 1125-A. To make this work in practice however. The net income will be reported on Line 2 of Form 1120.

Sales revenue minus cost of goods sold is a businesss gross profit. Gross profit is obtained by subtracting COGS from revenue while gross margin is gross profit divided by revenue. The cost of goods sold COGS also referred to as the cost of sales or cost of services is how much it costs to produce your products or services.

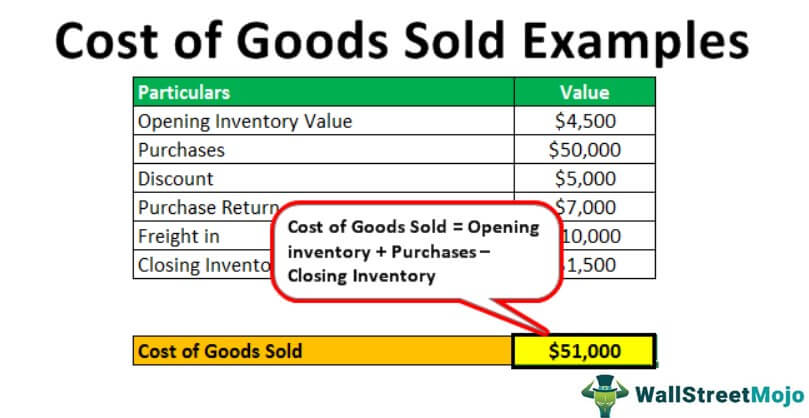

Now lets us apply the COGS formula and see the results. In these cases it is. This is calculated as follows.

Cost of goods sold. In this case even though our purchases amounted to 1800 our cost of goods sold or cost of sales amounted to 800. The total cost of these eight units is 2080.

Ad Get Complete Accounting Products From QuickBooks. What is the gross profit formula. The higher a companys COGS the lower its gross profit.

500 x 120 200 x 100 800. As a company selling products you need to know the costs of creating those products. Thats where the cost of goods sold COGS formula comes in.

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Accounting Cost Of Goods Your average cost per unit would be the total inventory 2425. The cost of goods sold equation. Gross Profit Revenue Cost of Goods Sold.

If a business has a beginning inventory worth 10000 purchases raw materials during the year for 15000 and the remaining inventory left for 5000 calculation of the cost of goods sold will be. Cost of Goods Sold COGS is the cost of a product to a distributor manufacturer or retailer. You can calculate this by using the following formula.

COGS is equal to the sum of the beginning inventory plus additional inventory minus. In this guide we explain five important accounting formulas how theyre calculated and when your business might use them. In this case the cost of.

These costs fall into the general sub-categories of direct labor materials. When the textbook is sold the bookstore removes the cost of 85 from its inventory and reports the 85 as the cost of goods sold on the income statement that reports the sale of the. Ad Get Complete Accounting Products From QuickBooks.

Cost of goods sold. Cost of goods sold formula. Rated The 1 Accounting Solution.

At a basic level the cost of goods sold formula is. So we have all the pieces in place. QuickBooks Financial Software For Businesses.

June 16 2022. The cost of goods sold formula is simple to use. Calculating Cost of Goods Sold COGS The formula for calculating COGS.

QuickBooks Financial Software For Businesses. LoginAsk is here to help you access Accounting Total Cost Formula quickly and. Gross Profit Revenue - Cost of Goods Sold Revenue Revenue is the total.

Cost Of Goods Sold Definition Cogs Formula More Patriot Software

Cost Of Goods Sold Cogs Formula And Calculator

Cost Of Goods Sold Formula Calculator Excel Template

Cost Of Goods Sold Examples Step By Step Cogs Guide

0 Response to "Accounting Equation Cost of Goods Sold"

Post a Comment